우리는 – 특히 스타트업 관련된 일을 하는 사람들 – 다음과 같은 말을 자주 한다. “벤처 정신으로 한번 해보는거야…”

‘벤처정신’이라는건 정확히 어떤 정신을 말하는 걸까? 나도 벤처 관련된 일을 하고 있고, 벤처 정신이라는 말을 자주 사용하지만 (어떨 때는 남발) 그 의미를 정확하게 정의하라고 하면 솔직히 잘 모르겠다. 아마도 그냥 뭔가 힘든 상황에서 굳은 각오를 하고 남들의 시선과 비난을 받으면서도 하고자 하는 걸 추구하는 뭐 그런 정신이 벤처 정신이 아닐까 싶다.

오늘은 이런 벤처 정신을 벤처가 아닌 일상생활에서 악조건을 무릅쓰고 실천하고 있는 어떤 일본인을 소개하고자 한다. 이 분에 대한 글을 읽은 후로 나는 어렵거나 힘든 일에 직면했을 때 항상 이 분의 얼굴을 떠올리고 다시 한 번 자신의 정신을 중무장하고 전쟁터로 뛰어들어간다. 여기 그 놀랍고도 대단한 이야기를 공유한다:

2011년 3월 11일 금요일 오후에 히데아끼 아카이와씨는 미야기현의 항구도시 이시노마키 사무실에서 한주의 업무를 마감하고 있었다. 이 아저씨가 정확히 어떤 일을 하시는지는 솔직히 아무도 모르지만, 앞으로의 활약을 고려해 짐작해보면 분명히 무슨 특공 대원이나 야쿠자 행동대원임이 분명하다.

그가 퇴근준비를 하고 사무실을 나오려고 하는 찰나에 땅이 흔들리기 시작했다. 지진이었다. 하지만, 그냥 지진이 아니었다 – 일본이 지금까지 경험했던 그 어떤 지진보다 훨씬 강도가 높은 초대형 9.0 지진이었다. 땅은 흔들리고, 빌딩들은 엿가락처럼 휘다가 무너지고, 간판은 종이처럼 하늘을 날아다녔다. 그리고 2년같이 길게 느껴졌던 2분 동안 일본 열도는 마치 놀이동산의 디스코 팡팡과 같이 미친 듯이 흔들렸다. 하지만, 이시노마키시에 덮친 불행은 여기서 끝난 게 아니었다. 아니, 이제 단지 시작일뿐이었다. 강진과 함께 발생한 높이 10미터 이상의 쓰나미는 3월 11일 아침까지만 해도 162,000명이 복작거리던 이 도시를 순식간에 수심 3미터짜리 작은 호수로 만들어버렸다.

히데아끼 아카이와씨는 서둘러서 집으로 달려갔지만, 이미 그의 집을 비롯한 도시의 모든 집은 물에 잠기어서 흔적조차 찾아볼 수가 없었다. 그를 더욱더 미치게 하였던 사실은 20년 동안 같이 살았던 그의 부인이 물밑 어디 선가에 갇혀있다는 것이었다. 집에서 그를 기다리고 있던 부인은 미쳐 쓰나미를 피하지 못했다. 아무리 전화를 해도 통화가 안 되었다. 수심은 계속 깊어져만 갔고, 이제 해는 지고 있었다. 그의 주변에는 자동차를 비롯한 온갖 똥과 쓰레기가 둥둥 떠내려가고 있었고 현장에 늦게 도착한 구조대원들은 현재로써는 아무것도 할 수 있는 게 없다고 했다. 아카이와씨가 유일하게 할 수 있었던 거는 그냥 앉아서 군인들이 일찍 도착해서 저 쓰레기더미 어디선가에서 부인을 구하기를 바라는 거였다. 그때까지 부인이 죽지 않았다면 말이다. 이미 이시노마키시에서만 1만 명 이상의 실종자가 발생하였고, 그의 부인이 발견될 확률은 거의 제로였다.

자, 이제부터 이야기는 시작된다.

우리와 같은 평범한 사람들은 이 상황이었으면 그냥 한숨만 팍팍 쉬면서, 정부랑 대통령 욕 심하게 하고 혼자 살아있음에 괴로워했을 것이다. 하지만 히데아끼 아카이와씨는 우리와 같은 평범한 사람이 절대 아니었다. 그는 하늘이 반으로 쪼개지더라도 그의 부인을 저 더러운 똥물에서 가만히 죽게 놔둘 위인이 아니었다. 그는 그녀를 구할 생각이었다. 수단과 방법을 가리지 않고.

그 이후, 그가 어떻게 그리고 어디서 잠수복과 스쿠버 다이빙 장비를 그 짧은 시간 안에 구했는지는 아직 아무도 모르는 미스터리다. 나는 지금 따뜻한 캘리포니아의 집에서 목이 말라 죽겠는데 콜라 하나 못 찾아서 온 집안을 헤매고 있는데, 이 일본 아저씨는 생사가 왔다 갔다 하는 이 절체절명의 순간에 산소통, 잠수복 그리고 스쿠버 장비를 어떻게 구할 수 있었을까. 정말로 뜻이 있다면 길이 있고, 강한 의지만 있다면 사막에서도 물을 찾을 수 있다는 말이 맞는 것일까

뭐, 그가 어떻게 이 장비들을 구했는지는 그다지 중요하지 않다. 중요한 점은 그는 부인을 구하기 위해서 스쿠버 장비를 구했다는 점이고 그는 잠수 장비로 중무장하고 바로 물로 뛰어들어갔다. 부인을 구출하거나, 아니면 구출하려고 노력하다가 물 안에서 죽거나 그런 각오로 뛰어들어 간 것이다. 한가지 재미있는 거는 – 그리고 다행임 – 아카이와씨가 이미 스쿠버 다이빙 장비를 다룰 줄 안다는 것이다. 그를 아는 사람들에 의하면 그는 부인을 바다에서 서핑하면서 만났다고 했다고 한다. 여기서 유추해보면 그가 이미 스쿠버를 할 줄 알았다는 결론이 생긴다. 어쨌든 간에 그건 상관없다. 아마 이 사람은 스쿠버를 전혀 못 해도 무조건 물속으로 뛰어들었을 테니까. 그는 지진이든 쓰나미든 말도 안 되는 자연재해가 사랑하는 가족의 목숨을 빼앗아가는 그런 현실을 받아들일 사람은 아니었다. 그는 차가운 물 속으로 깊이 잠수해서 그의 집이 있던 위치로 헤엄쳤다.

물속은 정말 가관 그 자체였다고 한다. 자동차, 건물잔해, 아직 살아있는 전선 등등 온갖 대형 쓰레기들을 마치 오락에서 주인공이 장애물들을 피하듯이 그는 피해 다녔다. 장난감 자동차와 같은 떠다니는 차들을 피해서, 깨진 유리 조각들에 산소통이 긁히지 않도록 조심스럽게 수영하면서 그의 집을 찾았다. 아카이와씨는 이 와중에서도 평상심을 잃지 않고 한가지 목표 – 부인 구출 – 에만 온 정신을 집중했고, 그의 집을 발견할 수 있었다. 다행히도 집안에는 얼굴만 물과 천장 사이에서 간신히 유지하고 있는 부인이 살아있었다. 그는 부인에게 미리 준비해간 예비 산소통을 입에 물려주고 안전하게 물 위로 나왔다. 아카이와씨의 부인은 무사히 구출되었다.

하지만, 히데아끼 아카이와씨는 여기서 멈추지 않았다. 그는 아직 할 일이 남아있었다. 이 시점에서 우리는 “아니 군대도 못하는 걸 단독으로 물속에 들어가서 부인까지 구출했는데 또 무슨 할 일이 남았단 말인가?”라는 질문을 하겠지만, 상황은 더욱더 흥미진진해진다. 아카이와씨의노모 또한 이시노마키에 살고 있었으며 그녀 또한 아직 발견되지 못했다. 일단 아카이와씨는 임시보호소들을 시작으로 온 도시를 돌아다니면서 어머니를 찾기 시작했다. 이미 쓰나미가 도시를 습격한 지 나흘이 지났고 그때까지 노모의 행방을 찾지 못하자 아카이와씨는 그가 뭘 해야 하는지 잘 알고 있었다. 아직도 도시는 물에 잠겨있었고 (물론 수심은 약간 낮아졌다.) 구조대원들은 여전히 꾸물대며 그가 원하는 만큼 빠리빠리하게 움직이지 않고 있었다. 그는 다시 한 번 자신의 운명은 자신의 손으로 스스로 해결하기로 하고 다시 한 번 스쿠버 장비를 착용하고 차가운 물로 뛰어들었다. 물속은 여전히 춥고, 컴컴하고 위험으로 가득 차 있었다. 그는 부인을 찾을 때처럼 무서울 정도로 침착하게 집중력 하면서 어머니를 샅샅이 찾기 시작했고 기적과도 같이 어떤 집의 지붕에 매달려있는 거의 죽기 일보 직전의 어머니를 발견했다. 그리고 마치 동화와도 같이 그는 노모 또한 안전하게 구출을 했다.

여기서 이야기가 끝은 아니다 ㅋㅋ. 우리가 기억해야 하는 점은 바로 히데아끼 아카이와씨는 우리와 같은 범인이 아니라는 것이다. 올해 43살인 그는 자신 가족들의 안전은 보장되었지만, 아직도 어디에선가 구조의 손길을 기다리고 있을 일본 시민들을 구출하기 위해서 그 이후 매일 자전거를 타고 순찰을 하고 있다고 한다. 그의 유일한 장비는 맥가이버칼, 물통, 후레쉬 그리고 선글라스다.

히데아끼 아카이와씨가 우리에게 몸소 보여준 그의 행동 – 이게 바로 나는 진정한 벤처 정신이라고 생각한다. 뭔가 일이 잘 풀리지 않을 때 우리는 백만 가지의 이유와 변명을 대면서 좌절할 수 있다. 그리고 그렇게 하는 게 훨씬 쉽다. 하지만, 그런다고 누가 우리의 고민을 들어주거나 해결해 주지는 않는다. 내가 무언가를 원한다면 내가 직접 두 손 걷어붙이고 해결해야 한다. 아카이와씨가 일본 정부에서 그의 부인과 어머니를 구해주길 기다렸다면 두 여성은 이미 죽었을 것이다.

청년실업을 정부에서 해결해 줄 수 없다. 자신의 불운을 시대를 탓하고, 정부를 탓하면 기분은 좋아질지 모르겠지만, 그렇다고 달라지는 것은 아무것도 없다. 자신의 비참한 처지를 개선하려면 모든 걸 내가 직접 해결해야 한다. 쓰나미에 맞선 히데아끼 아카이와씨처럼.

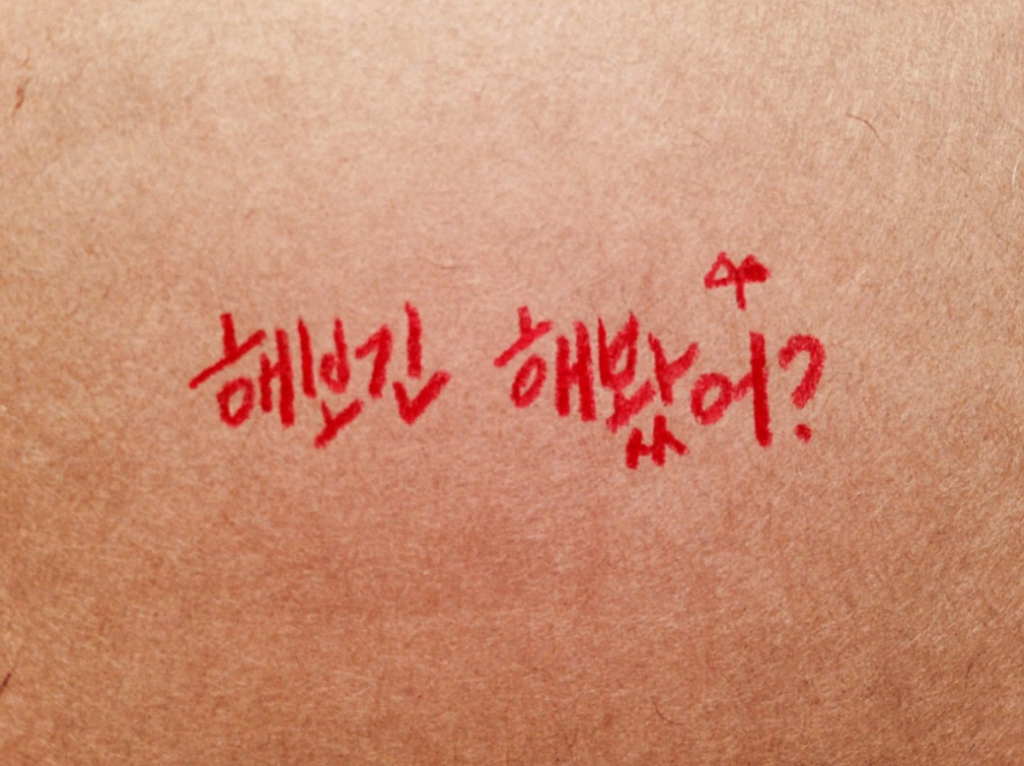

나는 이 글을 읽은 후부터 아카이와씨의 사진을 오려서 벽에 붙여 놓았다. 오늘 아침도 이 사진을 보고 다시 한 번 적군들로 우글거리는 전쟁터로 뛰어들어 승리하는 상상을 하면서…. 스스로를 벤처 정신으로 재무장하면서

<참고 및 이미지 출처 = “Badass of the Week: Hideaki Akaiwa” by Ben Thompson>